No Changes Budget Model Explained

Last Update: 11/29/2025

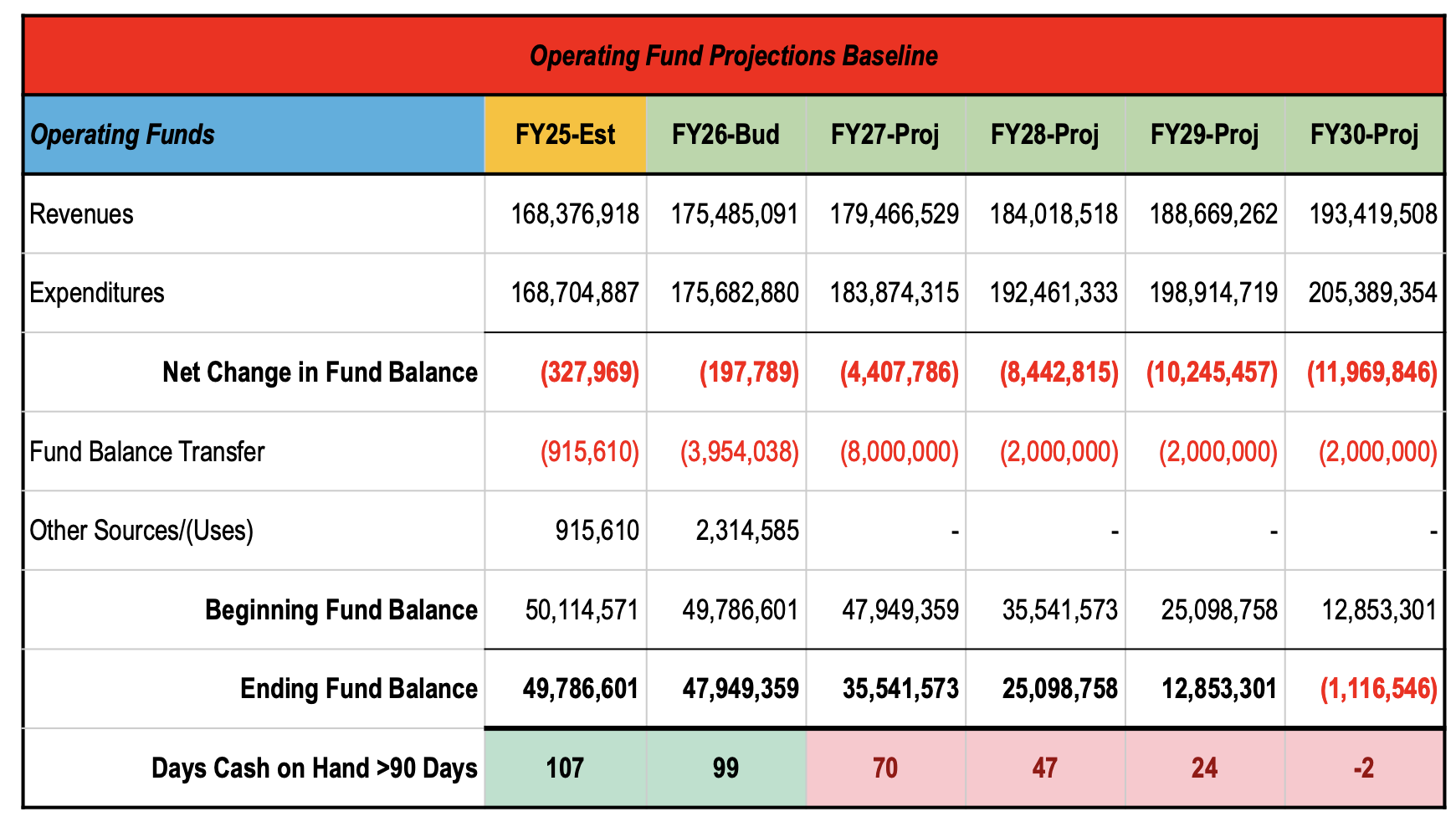

The district has presented a slide in several board meetings illustrating the budget scenario if we take no action. It has an unsettling amount of red text and negative numbers. It is also definitively not the case that the district will take no action; there is broad board, administration, and community support for taking decisive action to solve these financial issues. This view can be used to illustrate how our current reality differs from business as usual, but the table without context is hard to interpret.

This piece begins with definitions of key terms in the order they appear in the text. Click here to skip to the explanation.

Definitions

Definitions

- Structural Deficit: A budget imbalance where expenses are increasing faster than revenues

- Operating Expenses (OpEx): Short term, usually recurring costs to support day to day operations of an organization, such as salaries, debt payments, technology, and supplies. These are usually spent and tracked within a one year period.

- Capital Expenses (CapEx): Long term costs for assets that will benefit an organization for more than a year, such as constructing and maintaining buildings or vehicles.

- Fiscal Year (FY): A 12-month period used for budgeting, accounting, and financial reporting. A fiscal year may not align with a calendar year. District 65’s 2026 fiscal year 2026 runs from July 1, 2025 to June 30, 2026.

- Revenues: Money the district brings in as income.

- Expenditures: Money the district spends.

- Lease Certificates: Funding mechanism used to build Foster School. Investors buy lease certificates and make a profit when the district pays back the money owed plus interest.

- Fund Balance: A comparison of the district’s total assets (money it has) against liabilities (money it owes). Fund Balance can be thought of like a savings account.

- Deferred Maintenance: Postponing necessary upkeep and repairs of facilities, infrastructure, property, or equipment. This is usually done to save money in the short term but can lead to more expensive repairs in the long run.

- Debt Service Extension Base (DSEB): a provision under Illinois’s Property Tax Extension Limitation Law (PTELL) that allows local taxing districts (such as school districts) to levy a limited amount of property taxes to repay non-referendum bonds without seeking voter approval for the tax extension itself.

- Fund Balance Reserves, or Cash on Hand: A part of the fund balance set aside for specific purposes, such as emergencies or payment obligations.

- 90 Days Cash on Hand: The amount of money the district spends on operating expenses in a 90 day period. District 65’s goal is to maintain 90 days cash on hand.

- Referendum: A question on the ballot that offers the community a choice between accepting and rejecting a proposal.

Units

- Capital M in a dollar amount denotes millions rounded to two digits. For example, $3.2M represents $3,200,000 (rounded) and could reflect an underlying amount like $3,227,125.

- Capital K in a dollar amount denotes dollars rounded to the thousands. For example, $916K represents $916,000 (rounded) and could reflect an underlying amount like $915,610.

Budget Model Explanation

District CFO Tamara Mitchell gave a verbal explanation on how to read the table at the November 3 board meeting, but the table as presented comes with no footnotes or explanatory text. It also assumes the reader has a base understanding of financial terms. This table is driving important and impactful decisions for our community, and the general population deserves more insight and education on how to interpret and understand the financial crisis we are in.

There are two types of expenses that are considered when organizations are budgeting - operating expenses and capital expenses. This table covers operating expenses only.

The data is presented by fiscal year (FY). Fiscal Year 2025 (FY25) is complete but the final budget is likely not completely known as of this table’s construction, and this is why it is labeled as an estimate (“Est”). We are currently in FY26, and it is listed as budgeted (“Bud”). FY27, beginning on July 1, 2026, and future fiscal years (2028-2030) are not yet budgeted but can be estimated or projected (“Proj”).

Revenues and Expenditures are presented as total income and spent amounts for each fiscal year. It is noteworthy that beginning in FY26 expenditures increase in one new, specific way - lease certificate payments to fund the building of Foster School start coming due at $3.2M per year through FY2042.

The Net Change in Fund Balance line represents the difference between revenues and expenditures. Subtracting expenditures from revenues gives a negative amount each year, showing the district as up to $12M over budget by FY30.

While this table reflects operating expenses, when capital expenses are high, a standard practice is to move funds from the operating budget into the capital budget. This movement is reflected on the Fund Balance Transfer line.

Tamara Mitchell did not explain the FY25 ($916K) and FY26 ($3.95M) transfers in the November 3 board meeting, and it is unclear what these reflect.

The fund balance transfer of $8M in FY27 reflects two items. First, when Foster School construction is completed, the district has an estimated $6M in non-construction costs that will need to be paid to finish the school. Second, the district plans to move $2M to capital expenses to address deferred maintenance. The district also plans to spend $2M per year on deferred maintenance in FY28-FY30.

The Other Sources/(Uses) amount for FY26 was described at the November 3 board meeting as a one-time funding mechanism the district was able to leverage to make the first lease certificate payment, the debt service extension base authority. Tamara Mitchell noted that the district was able to gain $2.3M from this funding mechanism and if they had not, the FY26 deficit would have been $2.5M instead of $198K.

The beginning fund balance represents the amount the district has in fund balance reserves at the start of each fiscal year and at the end of each fiscal year, after the operating deficit is paid from the reserves and fund balance transfers are removed from the reserves.

Finally, the line for Days Cash on Hand >90 Days represents the anticipated number of days of expenses the district could cover with the fund balance reserves. The board has identified a target of maintaining 90 days worth of cash on hand and this is considered a best practice. There is no law or regulation requiring school districts to hold 90 days cash on hand and a review of historical budgets indicates that the district held 90 Days Cash on Hand only 7 times over the past 22 years, less than one-third of the time.